This article was last updated 05th May 2023 .

Business owners who are also directors of their Limited Companies typically extract profits via a blend of salary and dividends.

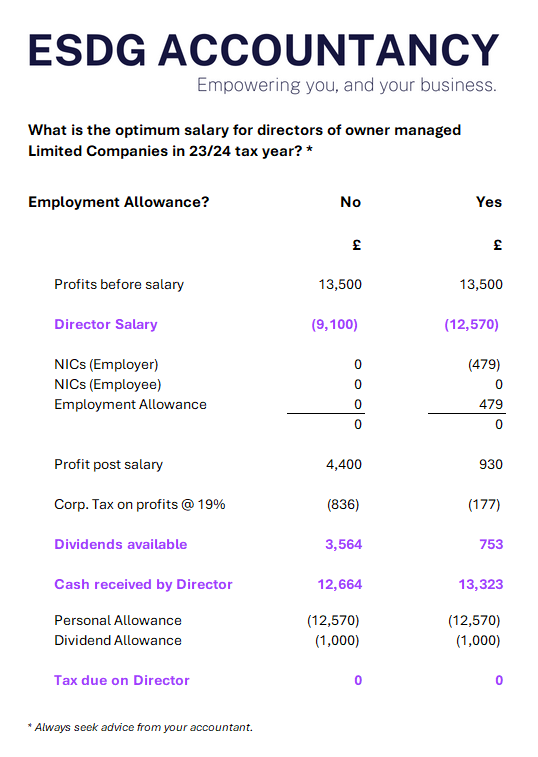

As we enter the 2023/2024 tax year, the optimum salary level for Directors has changed. Getting this mix right can legally minimise your tax bill.

This salary level should be regularly reviewed when new tax legislation comes into effect to ensure the most tax efficient strategy is being followed. Your accountant should offer advice here as part of their core service

The below information is generic and professional advice tailored to your specific circumstances should always be taken.

Skip to the detailed calculation.

Salaries or Dividends?

Salaries are preferable for the Limited Companies tax position in respect of corporation tax, as they are deductible as an expense.

Dividends are not tax deductible, and are paid out from post-tax profits.

However, incurring salaries above the national insurance thresholds will mean national insurance contributions come due, reducing the tax effectiveness of paying a salary. National insurance payments can be due from both the employee and employer, depending on the level of salary

Although dividends are paid from post-tax profit, the advantage is there is a £1,000 dividend allowance for the 23/24 tax year where no tax is due. Dividends also attract a lower basic rate tax at only 8.75%.

Are you eligible for the employment allowance?

Before we consider what this salary level should be, the first question is ‘can the business claim the employment allowance?’.

If eligible, the business can save up to £5,000 in Class 1 National Insurance contributions. The full eligibility criteria is given by HMRC here.

Typically, the employment allowance can usually be claimed if there are 2 or more directors or employees in the business (but please check this with your accountant as there are exceptions to this!).

If the employment allowance CAN be claimed and is available to be utilised…

Salary of £12,570 is generally the most optimum.

No NICs are payable by the employee and all employer NIC contributions are covered by the employment allowance.

If the employment allowance CANNOT be claimed…

Salary of £9,100 is generally the most optimum.

No NICs are payable however this will still count as a qualifying year for the director.

The full calculation can be seen below in this graphic:

Please talk to us if you would like assistance in maximising your profit extraction from your Limited Company.